Dogecoin Trading Volume Hits A 16-Week High

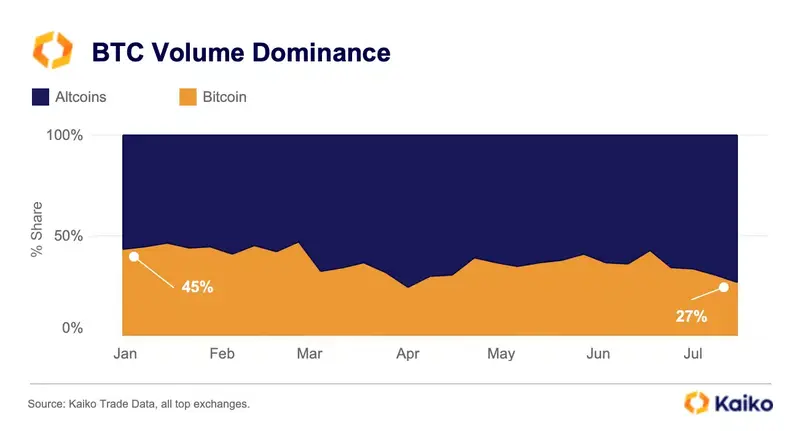

At just 27%, Bitcoin dominance across all of the top 25 centralized exchanges is currently at its lowest level since April 2023.

Offshore exchanges have experienced a significant decrease in Bitcoin (BTC) trading activity, partly because of a surge in altcoin trading volume in South Korea. Since the beginning of 2023, the dominance of BTC in the market has dropped by 20%. In the United States, altcoins have also gained popularity in the past month, indicating that the regulatory crackdown hasn’t affected demand much, reports Kaiko.

Altcoin liquidity, which refers to how easily these alternative cryptocurrencies can be bought or sold, has seen a small increase since the start of July. This data comes from Kaiko’s market depth, which looks at bids and asks for an asset across all centralized exchanges, giving a comprehensive view of the asset’s liquidity.

Since the beginning of July, the 1% market depth for the top 10 altcoins by market cap has grown by around $20 million.

Recommended Articles

Dogecoin Trading Volume Shoots 16-Week High

The world’s largest memecoin DOGE has been once again in the limelight. Defying the broader market consolidation, the Dogecoin (DOGE) price is up by 8% in the last 24 hours and is currently trading at $0.076 with a market cap of $10.7 billion. With the recent price surge, Dogecoin has toppled Cardano to become the seventh-largest cryptocurrency by market cap.

As per on-chain data provider Santiment, the Dogecoin trading volumes have touched a 16-week high. After the sudden price jump in Dogecoin today, many traders have shown interest in it. Litecoin is also seeing increased attention as its August 2nd halving event approaches. Keep an eye on Ethereum too.